2021 Annual Report

- Presentation

- Corporate Profile

- Sustainability at Türk Eximbank

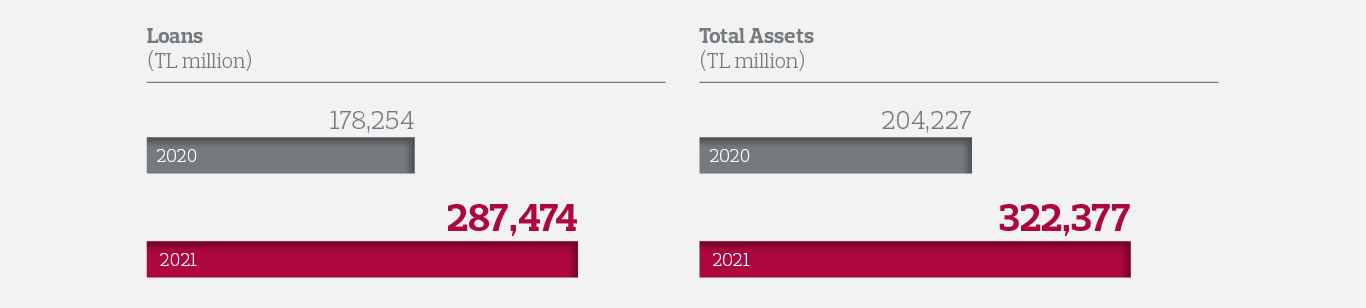

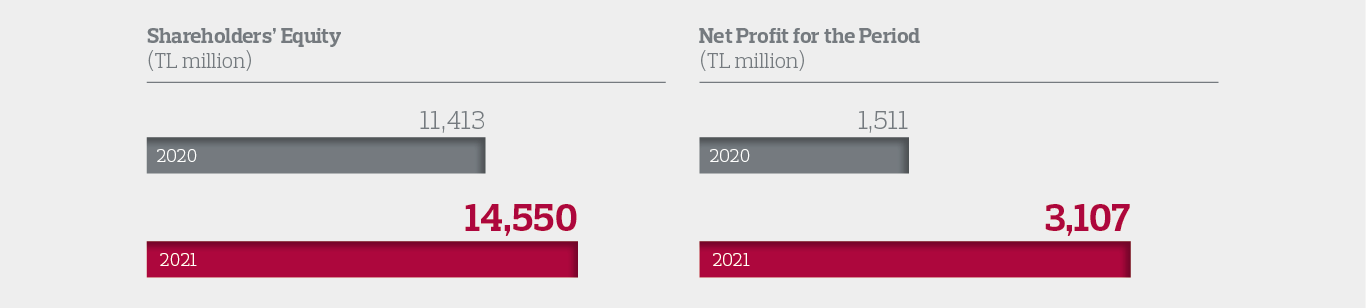

- Financial Highlights

- Summary Activity Indicators

- Chairman’s Message

- General Manager’s Message

- Historical Background

- Changes in the Articles of Association

- Capital Structure

- Türk Eximbank’s Position in the Turkish Banking Sector

- Overview of Türk Eximbank’s Activities in 2021

- Türk Eximbank’s Targets and Activities in 2022

- Independent Auditor’s Report on the Annual Report of Board of Directors

- Corporate Governance

- Financial Information and Assessment on Risk Management

- Relations of Türk Eximbank with Its Risk Group

- Support Services Obtained by Türk Eximbank

- The General Assessment of the Audit Committee for the Year 2021 Regarding Activities and Risk Management, Internal Control and Internal Audit Systems at Türk Eximbank

- Risk Management Policies Based on Risk Types

- Evaluation of Financial Position

- Credit Ratings Assigned to Türk Eximbank by International Rating Agencies

- Financial Indicators for the 2017-2021 Period

- Publicly Announced Unconsolidated Financial Statements and Related Disclosures together with Independent Auditor’s Report at 31 December 2021

- Directory